The construction and contracting industry in Saudi Arabia is booming, with many high-profile projects underway or in the planning stages. The sector presents a significant growth opportunity for businesses, but it’s important to be aware of the legal compliance issues that need to be considered in order to operate successfully and avoid any potential penalties.

This article provides an overview of some of the key legal compliance issues that are relevant to the construction and contracting industry in Saudi Arabia.

Saudi Arabia’s Leading Construction Projects

Saudi Arabia’s construction industry has seen significant growth in recent years, with many large-scale projects nearing completion. Here are some of the most notable construction projects in Saudi Arabia:

- The Riyadh Metro is a new metro system being built in the Saudi capital city of Riyadh, costing approximately $22 billion. The metro will have six lines, 85 metro stations and a total length of 176 km, making it one of the largest urban transport projects in the world. It is expected to open to its first passengers sometime in 2022.

- The Qiddiya Project is a new entertainment city being built near Riyadh with a total area of 334km2. The mega project will include theme parks, a water park, a racing track, and the capacity to host large sporting events. The cost of the project is estimated at $8 billion. When completed, it will be the largest tourism destination in the world.

- Neom is a new mega-city being built in the northwest of Saudi Arabia with a total area of 26,600km2. The goal of this development is to create a city that will not just be a destination, “but a home for people who dream big and who want to be part of building a new model for sustainable living”. The cost of the project is estimated at $500 billion. The city will be powered by renewable energy and will include high-tech industries, a resort area, and a university.

- The Red Sea Project is one of the world’s most ambitious tourism development programmes, located along Saudi Arabia’s Red Sea coast. The project will include luxury hotels, a marina, and a nature reserve. Although the cost of the project is estimated at $10 billion, it is expected that upon completion it will increase Saudi Arabia’s GDP by $5.86 billion per year.

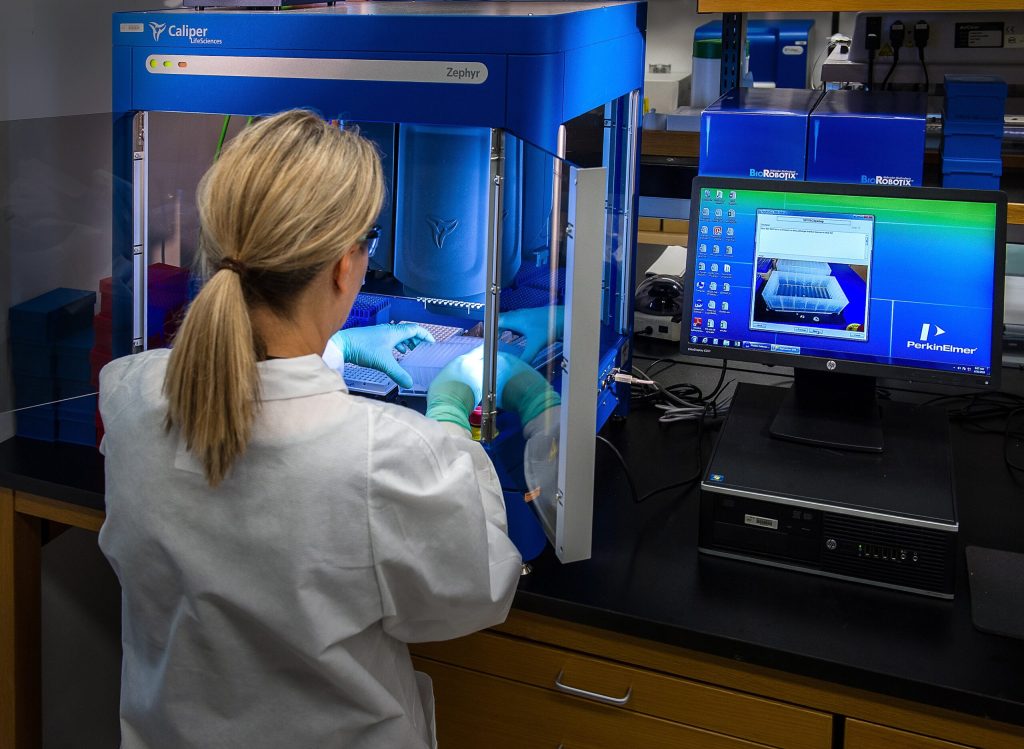

Legal & Regulatory Frameworks Affecting The Industry

Saudi Arabian law is uncodified and relies on a set of Shari’ah principles interpreted from Islamic religious texts. Currently, there is no complete set of construction laws regulating the industry, and parties are free to enter a contract as long as their agreements do not offend the fundamentals of Shari’ah.

Procurement & Tenders

With regards to procurement, an amended Government Tenders and Procurement Law (GTPL) was introduced in 2019 and sets out the rules and procedures for government contracting. Since the majority of major construction projects in Saudi Arabia are government-sponsored, this law is highly relevant to the industry.

The GTPL requires all government contracts to be tendered openly and transparently, with contracting authorities required to publish notices of contracting opportunities and award contracts to the winning bidder after a fair and open tender process.

Real Estate Ownership & Development

The Saudi Arabian government has placed a number of restrictions on non-GCC foreigners owning property in the Kingdom. They may only own the property for the purpose of residency and are restricted from acting as a landlord or owning more than one property.

Businesses owned by foreigners can purchase real estate for the purpose of business activities, including accommodation for employees. Within the holy cities of Makkah and Medina, only Saudis are permitted to purchase properties.

Construction Permits & Licenses

In 2017, the government announced that contractors must register with the Saudi Contractors Authority. The authority is responsible for the regulation and control of the construction industry in Saudi Arabia. In 2020, it was discovered that out of 140,000 contracting companies, only 4000 were registered. It was subsequently announced that contractors won’t be awarded building permits or be able to bid on government projects if they are not registered with the authority.

The Future of the Construction Industry in Saudi Arabia

As the Saudi Arabian construction industry continues to grow and attract foreign investment, additional regulation is likely to be introduced in order to ensure the sector remains compliant. In particular, the government is likely to focus on increasing transparency and preventing corruption in the industry. Foreign investors and contractors should ensure they are aware of the relevant regulations before entering into any construction contracts in Saudi Arabia.